CoCIS Hosts the first MURBS-Stanbic Financial Literacy Clinic

In the university setting, staff and students are concerned with teaching and learning and managing university affairs. This time, Makerere University Retirements Benefits Scheme (MURBS), the university management and Stanbic Bank have created an opportunity and forum for staff and students to reflect on their finances and how to plan to live a better life after retirement.

If you are there and you have failed financially, this is the time to think about how you can redeem yourself. If you are there and debts have clobbered you around, the financial literacy clinics are here to help.

If you are there and you have never invested and you fear to invest, there is an opportunity to learn the different investment options that are available. If you have invested and are successful think about sharing your success story so that people can learn from you.

On Thursday 24th November, 2022 over 50 participants comprising staff and students from the College of Computing and Information Sciences (CoCIS) converged in Block A conference room for a financial literacy training session organised by MURBS and Stanbic Bank Uganda.

Staff and students were equipped with knowledge and skills in thinking holistically about their money, how to manage personal finances, developing a saving culture, handling loans with care and making investments.

In addition, staff and students were trained on how to protect their families future through insurance, planning for old age through viable investments and getting to know the financial service products.

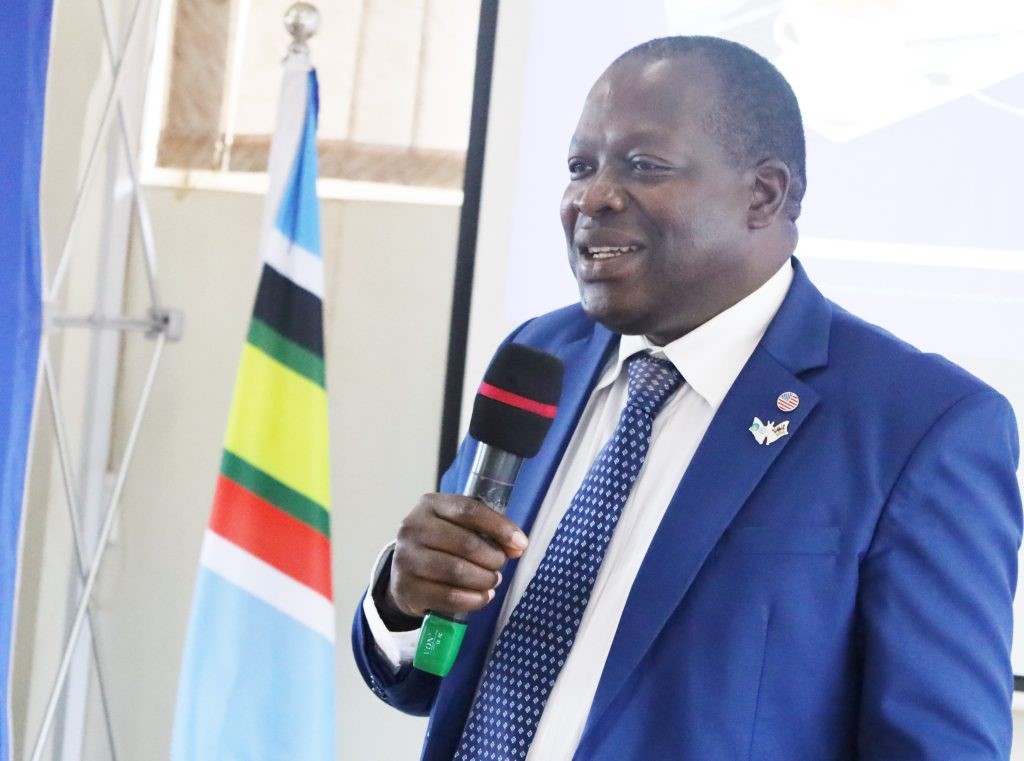

The session moderated by staff from Stanbic Bank was graced by the College Principal Prof. Tonny Oyana. He underlined the basic principles towards financial success which include saving.

“Asians have a very good saving culture and save up to 30 to 40%. Africans are very good at spending and spending up to 100 % and have a very good culture of wanting to show off. Make sure you save at least 10% of your earnings”. Oyana said.

The second principle according to Prof. Oyana is an investment for the future, third is giving your best and sacrifice so as to feel good about and make a difference in other people’s lives.

The Principal highlighted important concepts in financial management including financial literacy which is the ability to effectively use various financial skills including personal financial management, budgeting and investing.

Prof. Oyana also introduced key concepts which include having a healthy relationship with money, financial freedom and financial security.

“Security involves having enough money to comfortably care and cover your monthly expenses and recover from financial setbacks. And one of the features is comfortable retirement. “He added.

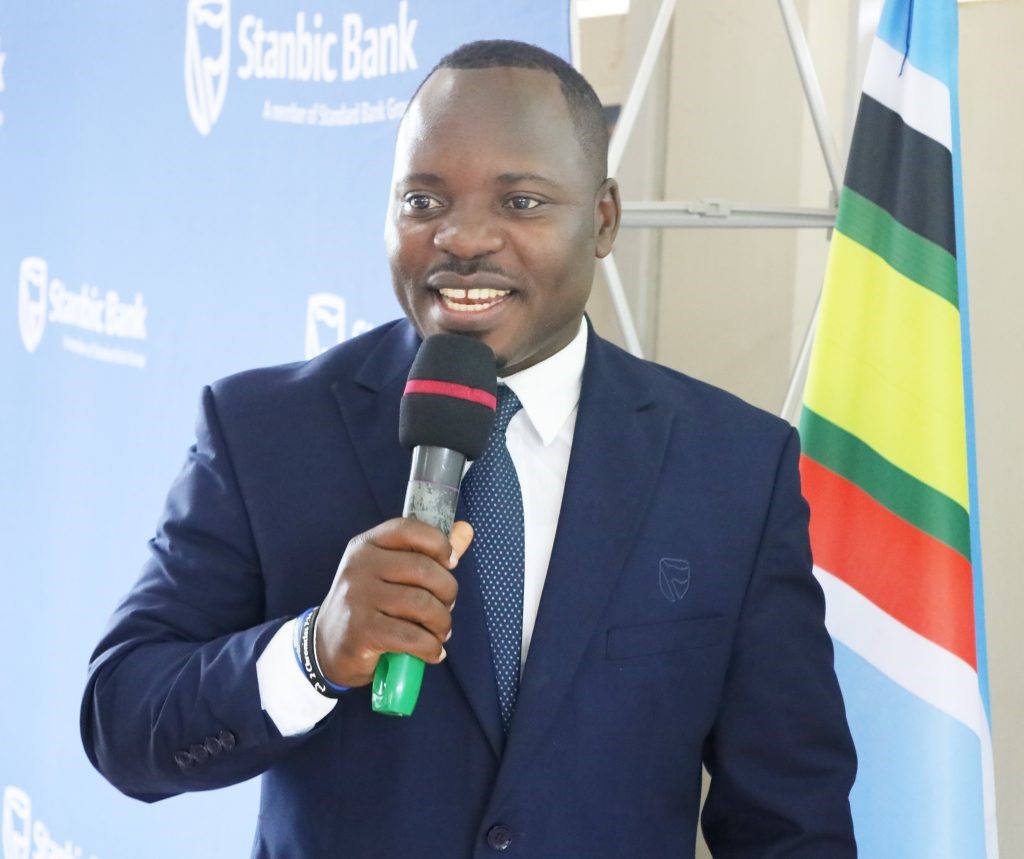

Stanbic Bank new relationship Manager for Makerere University Frank Kaggwa said Stanbic bank has made 160 years of existence but equally important, Makerere University has also made 100 years hence something in common that the two institutions have to celebrate.

Kagwa says the best service that can touch the lives of employees, is personal financial management.

“We decided with the management of the bank, MURBS and Makerere to make sure that at least we extend financial knowledge to all employees and this is what we have done today. It has been the first of its kind. We have not done it in any university and it has been a success. We have fused the employees and students which is sustainable and cuts out very well”, Kaggwa explained.

The key aspects covered during the training included how to create and build wealth.

“Wealth is not spontaneous you do not wake up in the morning and you are wealthy. It is a long life journey. Many people work and get scared of retiring because they see no hope of where they are going”. He said

Kaggwa explained how staff can save and invest, giving investment options of how staff can create employment opportunities which can be as small as rearing chicken in the village, setting up a kiosk, a shop and a farm among others.

He also emphasised that life is not about work, and, therefore, staff need to enjoy and spend about their money but only spend knowing they have invested.

In his key message to staff and students of Makerere University, Kagwa stressed that they are not selling products but extending what they are good at, which is financial knowledge.

“If anyone dares to miss, they are missing at their own cost. Please come and get this insightful, inspirational, participative and informative knowledge you have not had access to”. He said.

Statistics show that Uganda’s population is financially stressed with 41% living in poverty. 46% of Uganda’s population are under the age of 15. 33% of the population have an account at a financial institution but, 52 % are financially illiterate.

The need for financial literacy training for employees is also based on the fact that 25% of employees spend most of the day worrying about their finance thinking about what to eat, transport, fees, health needs etc.

Studies also show that 80% of Human Resources want to help their employees. Although a significant number (98% ) of employees save for retirements only 5% attain financial independence in an average of 2 years of life.

Compiled by;

Jane Anyango.

Principal Communication Officer, CoCIS.